We are due for a debt unwind, and with it a rapid decline in the US standard of living. Exactly what form it will take, and what the timing will be (for example, sudden one month from now or sudden three years from now, or gradual over a longer period), isn't certain. I would expect that many (or most) other economies in the world will be dragged along in this debt unwind and will experience a decline in their standards of living.

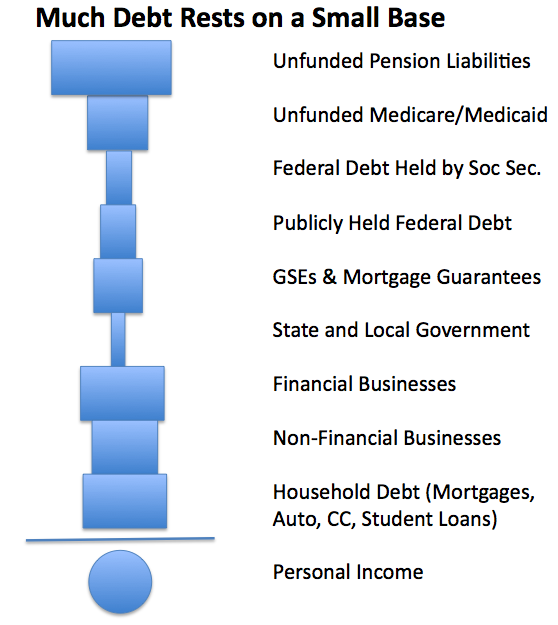

Many asset classes are correlated in time of stress, the tower of debt (Figure 1) has many feedback loops, and tends to magnify the economy's reaction to events, both favorable and unfavorable.

(FIGURE 1) (click on figure to read)

When consumer debt is rising it tends to make the economy look very, very good. When there are layoffs, the interrelationships tend to magnify the impact, making the economic impact much worse. One wonders whether there are tipping points, beyond which it is not really possible for the system to recover--particularly now that the US seems to be at the point of "peak energy" (Section 3), energy is required for growth (Section 3), and growth is required to allow debt to continue (Section 2).

The tower of debt is in some ways deceptive. It can make the economy look mostly OK to the casual observer, until all too quickly, things start to fall apart.

So far, the "fixes" that the US government has been attempting seem mostly counterproductive. Putting government guarantees behind more and more debt (thus stacking Figure 1 higher and higher, with a new TARP layer) just increases the likelihood that the US government will be drawn into the downward spiral. The financial services layer will be less and less needed in years ahead, as our need for debt-based products declines. Bailing it out does not help get additional income to ordinary workers (although it may temporarily protect them from losing their bank account balances).

All aspects of finances will be affected by the unwind of debt. A huge amount of debt will be defaulted on (or will be forgiven, so that an actual default does not need to occur). Regardless of whether the non-payment occurs because of default or forgiveness, the effect on financial institutions will be the same. Financial institutions such as banks, insurance companies, pension funds, and many hedge funds will find themselves in poor financial condition, because they were depending on the proceeds of this debt repayment to fund what they have promised--bank account balances; insurance policies; pension payments; or hedge fund returns. Institutions guaranteeing debt, such as monoline bond insurers will be particularly hard hit. The FDIC will likely be called on to rescue many failed banks, and will need to find funds from some source (printed money?) to do this.

As the year goes on, I expect each evaluation of where we are to be worse. Banks will report operating losses each quarter. Fannie and Freddie will need more funds than originally thought. TARP will need more funds than original planned. More and more businesses will enter bankruptcy, and more and more governments (states, cities, counties, and countries around the world) will find themselves unable to meet their obligations. There are a huge number of inter-relationships, and the bankruptcies and losses in one area will tend to cause more bankruptcies and losses in other areas, and act to destabilize the debt tower.

Debt of all forms will be very difficult to obtain, except through government sources. The interest rate the US government is currently paying is very low, mainly because of a "flight to quality". If the US government keeps issuing more and more debt, it seems likely that at some point this will change, because buyers will figure out that even if the US is the best of a bad lot, its risk of failure is significantly greater than 0%.

I do not expect a steep rise in the price of oil and natural gas in the next year, because the decline in demand is likely to outpace the decline in production in the short-term. If we look back at Figure 2, I expect that funds available to ordinary citizens will continue to decline in 2009, even considering any stimulus plan. This will happen because employee compensation will decline due to layoffs. Household debt outstanding will also decline (rather than just stay flat, as it has in the past year), because of the poor financial condition of lending institutions, and because with the poor economy, the risk of borrower default will be quite high, discouraging lending. A $300 billion stimulus program will be tiny in comparison to the boost the economy got in the past from increasing debt and greater refinancing (up to $2 trillion per year), as the prices of homes increased. With lower incomes, lower (actually net negative) cash flow from borrowing, and only a modest boost from a stimulus program, citizens will have less and less to spend on goods and services.

There is a distinct possibility that this could all end very badly. One possibility is that there will be more and more defaults, and the US government will not be able to prop up all of the institutions and will eventually default on its debt. While this seems to be the direction things are headed at the current time, the much more usual outcome is hyperinflation, caused by printing more and more money, wiping out the value of people's savings and pensions. Situations such as these are often accompanied by a new government (including a new constitution), and may even include different country boundaries (for example, Soviet Union after its fall).

Many people have started making preparation for the time when food needs to be produced locally and electricity is often not available. I would not discourage such preparations. While we do not know that the economy will collapse completely, I think such preparations are prudent, in the face of rising risk. Preparation for a major change takes many years, so starting earlier rather than later makes sense. Also, with the tower of debt (Figure 1) and the many feedback loops, the downward spiral can happen more quickly than our prior experience suggests is possible.

In conclusion, 2009 looks like a very challenging year for the new administration and for the world as a whole.

No comments:

Post a Comment