January 30, 2009

Washington, D.C.

Associated Press

Economy has worst slide since `82 -- and tailspin is accelerating as Americans ax spending

Battered by layoffs, debts and dread of worse to come, shoppers clutched ever tighter to their wallets in the final three months of 2008 and thrust the economy into its worst downhill slide in a quarter-century. Americans cut spending on everything from cars to computers, and it's only getting worse so far in the new year. (Continued here)

Friday, January 30, 2009

Economy's New Plunge is Worst in Quarter-Century, by Jeannine Aversa

Posted by

Clifford J. Wirth, Ph.D., Professor Emeritus, University of New Hampshire

at

Friday, January 30, 2009

0

comments

Thursday, January 29, 2009

Mass Layoffs Continue at Rapid Pace, by Christopher S. Rugaber

January 28, 2009

Washington, D.C.

Associated Press

Mass layoffs involving 50 or more workers increased sharply last year, and large job cuts appear to be accelerating in 2009 at a furious pace.

Boeing, Pfizer, Home Depot and other U.S. corporate titans have announced tens of thousands of job cuts this week alone.

The economy is likely to continue to shed jobs for the rest of this year, even if an economic stimulus bill pushed by President Barack Obama is approved, economists said. (Continued here)

Washington, D.C.

Associated Press

Mass layoffs involving 50 or more workers increased sharply last year, and large job cuts appear to be accelerating in 2009 at a furious pace.

Boeing, Pfizer, Home Depot and other U.S. corporate titans have announced tens of thousands of job cuts this week alone.

The economy is likely to continue to shed jobs for the rest of this year, even if an economic stimulus bill pushed by President Barack Obama is approved, economists said. (Continued here)

Posted by

Clifford J. Wirth, Ph.D., Professor Emeritus, University of New Hampshire

at

Thursday, January 29, 2009

0

comments

The Wall Street Journal: "Be Prepared for More Cutbacks," by Anna Prior

January 26, 2009

The Wall Street Journal notes that "Unemployment is hitting numbers we haven't seen in over a decade," and that many companies are cutting costs through layoffs and salary reductions and freezes. The Journal offers advice for cutting family expenses and securing your job.

The Wall Street Journal notes that "Unemployment is hitting numbers we haven't seen in over a decade," and that many companies are cutting costs through layoffs and salary reductions and freezes. The Journal offers advice for cutting family expenses and securing your job.

Posted by

Clifford J. Wirth, Ph.D., Professor Emeritus, University of New Hampshire

at

Thursday, January 29, 2009

0

comments

Friday, January 23, 2009

Gerald Celente: Economic Trends for 2009

Gerald Celente is Editor and Publisher of "The Trends Journal"

Interivew MP3 January 17, 2009

Summary of the Interview: (not quotations)

The trend for 2008 was panic, a crashing stock market, some major retail store closings, and the loss of 2 million jobs in the last quarter of 2008.

The global economy will collapse in 2009, resulting in the worst recession in the post WW II period. The commercial real estate sector is highly leveraged and will collapse beginning in late February and March as major retailers and financial institutions fail, leaving vacant rental space that will not be filled. This will lead to further failures in the finance and banking sectors and higher unemployment.

Real unemployment is 13% and growing.

Some two-thirds of the economy is based on consumerism, which is declining rapidly due to increasing unemployment. Declining personal income means a shrinking tax base and a need to raise state, local, and federal taxes and user fees.

This will lead to the "Greatest Depression," increased street crime, more corporate fraud, taxpayer revolts, rioting, and "revolution." Survival is now a real concept as people lose investments and jobs. A return to frugality and self-sufficiency will characterize the economy in years to come.

Interivew MP3 January 17, 2009

Summary of the Interview: (not quotations)

The trend for 2008 was panic, a crashing stock market, some major retail store closings, and the loss of 2 million jobs in the last quarter of 2008.

The global economy will collapse in 2009, resulting in the worst recession in the post WW II period. The commercial real estate sector is highly leveraged and will collapse beginning in late February and March as major retailers and financial institutions fail, leaving vacant rental space that will not be filled. This will lead to further failures in the finance and banking sectors and higher unemployment.

Real unemployment is 13% and growing.

Some two-thirds of the economy is based on consumerism, which is declining rapidly due to increasing unemployment. Declining personal income means a shrinking tax base and a need to raise state, local, and federal taxes and user fees.

This will lead to the "Greatest Depression," increased street crime, more corporate fraud, taxpayer revolts, rioting, and "revolution." Survival is now a real concept as people lose investments and jobs. A return to frugality and self-sufficiency will characterize the economy in years to come.

Posted by

Clifford J. Wirth, Ph.D., Professor Emeritus, University of New Hampshire

at

Friday, January 23, 2009

0

comments

Labels:

depression,

economic forecasting,

recession

Wednesday, January 21, 2009

ASPO Examines the Economy and Peak Oil: December 2008

Excerpts from the Association for the Study of Peak Oil and Gas (ASPO-Ireland) December 2008 Newsletter. The full article is available here.

In years ahead, analysts may look back on the current crisis and identify its causes. They may conclude that oil demand had begun to outpace supply around 2005, when the production of Regular Conventional Oil passed its peak. The shortfall was however relatively small and was partly met without undue difficulty by a modest reduction in consumption.

But as prices began to firm, oil traders and other speculative financial institutions began to take a position in the market, which had the effect of driving up the price. Gradually the process built momentum as huge notional profits were reaped from the appreciating asset. In a conventional market such movements would soon be countered by increased production, but in the case of oil, there was no spare capacity to release, and the speculative surge fed on itself leading to an extreme escalation in price which reached about $150 a barrel by July 2008. However as this peak [in prices] was approached, the traders began to conclude that a limit was close and began to buy future options at lower prices, which began to undermine the price in a self-fulfilling process. In parallel the high prices began to undermine many other aspects of the economy with for example airlines and automobile manufacturers facing difficulties. They themselves relied heavily on debt, which itself was traded between banks without adequate genuine collateral, and were forced to unload their speculative oil positions in order to try to shore up their failing businesses. Gradually the whole edifice collapsed, and oil prices fell to around $50 a barrel, although nothing particular had changed in the actual supply/demand relationship.

The flaw in the system was to treat a finite resource whose production was largely controlled by the immutable physics of the reservoir as if it were a normal commodity capable of responding to ordinary market pressures. If the price of potatoes increases, farmers can grow more and the market responds, but oil is different.

Governments responded to the crash by pouring yet more money, itself lacking genuine collateral, into the system in the mistaken belief that this would restore the position of assumed eternal growth, and quite possibly the stock market will respond positively as traders sense a new upward direction. They have no real interest in reality: their job being to try to reap rewards from short term movements.

But if there is an economic recovery, that would serve to increase the demand for oil, which is in a sense the lifeblood of the modern world, and oil prices would again begin to surge. Probably, it will take several such vicious circles before governments and, more important, people at large at last come to grasp the reality of the situation, which will likely prompt radical changes in the human condition.

The election of Mr Barrack Obama seems to have been greeted with rapture in the United States and around the world. Certainly he projects an attractive personality and speaks fluently and well, but the main enthusiasm seems to lie in his mixed racial background. Part of his family emanates from Kenya, possibly having some Arab blood, and the Irish stake claim to other antecedents. Some observers hope that his election will spell regime change and the end of the so-called War on Terror, which seems to have failed to extend global economic hegemony. On the other hand, his election, which required massive funding, suggests that he relied on more than the simple ballot box. Indeed, the financier, Rahm Emanuel, who has apparently served in the Israeli Army and is the son of a former member of the Irgun Zvai Leumi terrorist movement, has been appointed as Chief of Staff, suggesting that the established influences will remain in power. But by all means, most people welcome the change, and look forward with enthusiasm to new policies with which to face the unfolding situation, imposed ultimately by dwindling oil-based energy.

The new Presidency will certainly have to work a radically new situation for which no one is truly prepared. Even the leading American intelligence organisation, the National Intelligence Council (NIC) has issued a report entitled Global Trends 2025: A World Transformed which concludes that the days of US global economic and military power are over, foreseeing an end to the western model of economic liberalism, as the State is forced to take a more active role.

Meanwhile, desperate efforts are being made around the world to shore up the crumbling financial system. For example, the Bank of England has radically reduced interest rates in a country facing a severe recession, effectively taking money from savers to give to spenders.

The Government has evidently failed to grasp the underlying causes of recession and hopes that pumping a bit of money into the system will restore it to its previous condition. That was premised on eternal economic growth, which is a somewhat unrealistic proposition for a Planet of finite dimensions, but Governments subject to re-election are by nature short-term in their thinking.

The reporting of economic parameters: the official US numbers are apparently also highly suspect. The US Bureau of Labor Statistics (BLS) reports that US Consumer Price Inflation (CPI) is running at 5%, having changed the procedure for doing so in 1990. According to shadowstats.com, a more realistic estimate would be 13%. The Federal Reserve Bank no longer reports the so-called M3 for the creation of new money, but the same source suggests it is currently running at 13%, contributing to inflation. Officially, Gross Domestic Production (GDP) has increased by 2%, whereas the alternative source suggests that it is declining at 3%. Likewise, official estimates of unemployment at 6% contrast with the alternative estimate of 15%. Added credibility for the alternative assessment comes from no less than General Motors, which reports that global passenger car sales fell by 6% during the Third Quarter of this year. Apparently, various hidden agencies related to the Federal Reserve Bank may be manipulating gold and silver prices, which have fallen since the financial crisis broke. The fall does not seem a natural response, given that gold is the traditional safe haven in times of stress and growing inflation. Indeed according to the August issue of the Bank Participation Report, Bear Stearns had a large short position on COMEX silver at the time of its forced merger with JP Morgan in March. The transfer was undertaken by the US Treasury under somewhat dubious procedures. No doubt gold holdings are also involved in the labyrinthine dealings.

One is led to conclude that the entire Stock Market, including especially the oil market, has become a thoroughly debased speculative institution. In earlier years, investors clubbed together to build a specific project, such as a canal or railway, with the resulting dividend being the prime motivation. Things seemed to have gone wrong when such investments were traded on markets by financial institutions which naturally can have no serious knowledge of the underlying business or the true value to be placed upon it.

In years ahead, analysts may look back on the current crisis and identify its causes. They may conclude that oil demand had begun to outpace supply around 2005, when the production of Regular Conventional Oil passed its peak. The shortfall was however relatively small and was partly met without undue difficulty by a modest reduction in consumption.

But as prices began to firm, oil traders and other speculative financial institutions began to take a position in the market, which had the effect of driving up the price. Gradually the process built momentum as huge notional profits were reaped from the appreciating asset. In a conventional market such movements would soon be countered by increased production, but in the case of oil, there was no spare capacity to release, and the speculative surge fed on itself leading to an extreme escalation in price which reached about $150 a barrel by July 2008. However as this peak [in prices] was approached, the traders began to conclude that a limit was close and began to buy future options at lower prices, which began to undermine the price in a self-fulfilling process. In parallel the high prices began to undermine many other aspects of the economy with for example airlines and automobile manufacturers facing difficulties. They themselves relied heavily on debt, which itself was traded between banks without adequate genuine collateral, and were forced to unload their speculative oil positions in order to try to shore up their failing businesses. Gradually the whole edifice collapsed, and oil prices fell to around $50 a barrel, although nothing particular had changed in the actual supply/demand relationship.

The flaw in the system was to treat a finite resource whose production was largely controlled by the immutable physics of the reservoir as if it were a normal commodity capable of responding to ordinary market pressures. If the price of potatoes increases, farmers can grow more and the market responds, but oil is different.

Governments responded to the crash by pouring yet more money, itself lacking genuine collateral, into the system in the mistaken belief that this would restore the position of assumed eternal growth, and quite possibly the stock market will respond positively as traders sense a new upward direction. They have no real interest in reality: their job being to try to reap rewards from short term movements.

But if there is an economic recovery, that would serve to increase the demand for oil, which is in a sense the lifeblood of the modern world, and oil prices would again begin to surge. Probably, it will take several such vicious circles before governments and, more important, people at large at last come to grasp the reality of the situation, which will likely prompt radical changes in the human condition.

The election of Mr Barrack Obama seems to have been greeted with rapture in the United States and around the world. Certainly he projects an attractive personality and speaks fluently and well, but the main enthusiasm seems to lie in his mixed racial background. Part of his family emanates from Kenya, possibly having some Arab blood, and the Irish stake claim to other antecedents. Some observers hope that his election will spell regime change and the end of the so-called War on Terror, which seems to have failed to extend global economic hegemony. On the other hand, his election, which required massive funding, suggests that he relied on more than the simple ballot box. Indeed, the financier, Rahm Emanuel, who has apparently served in the Israeli Army and is the son of a former member of the Irgun Zvai Leumi terrorist movement, has been appointed as Chief of Staff, suggesting that the established influences will remain in power. But by all means, most people welcome the change, and look forward with enthusiasm to new policies with which to face the unfolding situation, imposed ultimately by dwindling oil-based energy.

The new Presidency will certainly have to work a radically new situation for which no one is truly prepared. Even the leading American intelligence organisation, the National Intelligence Council (NIC) has issued a report entitled Global Trends 2025: A World Transformed which concludes that the days of US global economic and military power are over, foreseeing an end to the western model of economic liberalism, as the State is forced to take a more active role.

Meanwhile, desperate efforts are being made around the world to shore up the crumbling financial system. For example, the Bank of England has radically reduced interest rates in a country facing a severe recession, effectively taking money from savers to give to spenders.

The Government has evidently failed to grasp the underlying causes of recession and hopes that pumping a bit of money into the system will restore it to its previous condition. That was premised on eternal economic growth, which is a somewhat unrealistic proposition for a Planet of finite dimensions, but Governments subject to re-election are by nature short-term in their thinking.

The reporting of economic parameters: the official US numbers are apparently also highly suspect. The US Bureau of Labor Statistics (BLS) reports that US Consumer Price Inflation (CPI) is running at 5%, having changed the procedure for doing so in 1990. According to shadowstats.com, a more realistic estimate would be 13%. The Federal Reserve Bank no longer reports the so-called M3 for the creation of new money, but the same source suggests it is currently running at 13%, contributing to inflation. Officially, Gross Domestic Production (GDP) has increased by 2%, whereas the alternative source suggests that it is declining at 3%. Likewise, official estimates of unemployment at 6% contrast with the alternative estimate of 15%. Added credibility for the alternative assessment comes from no less than General Motors, which reports that global passenger car sales fell by 6% during the Third Quarter of this year. Apparently, various hidden agencies related to the Federal Reserve Bank may be manipulating gold and silver prices, which have fallen since the financial crisis broke. The fall does not seem a natural response, given that gold is the traditional safe haven in times of stress and growing inflation. Indeed according to the August issue of the Bank Participation Report, Bear Stearns had a large short position on COMEX silver at the time of its forced merger with JP Morgan in March. The transfer was undertaken by the US Treasury under somewhat dubious procedures. No doubt gold holdings are also involved in the labyrinthine dealings.

One is led to conclude that the entire Stock Market, including especially the oil market, has become a thoroughly debased speculative institution. In earlier years, investors clubbed together to build a specific project, such as a canal or railway, with the resulting dividend being the prime motivation. Things seemed to have gone wrong when such investments were traded on markets by financial institutions which naturally can have no serious knowledge of the underlying business or the true value to be placed upon it.

Posted by

Clifford J. Wirth, Ph.D., Professor Emeritus, University of New Hampshire

at

Wednesday, January 21, 2009

1 comments

Labels:

econmic forecasting,

economy,

peak oil

The Wharton School: Global Economic Forecast for 2009

Knowledge@Wharton

January 7, 2009

After a year of financial shock and sharp economic loss, 2009 is likely to be extremely difficult for the global economy, with investors, business leaders and policymakers struggling to find signs of recovery, according to Wharton faculty and academic partners around the world.

"It's all pretty negative," says Wharton finance professor Franklin Allen. "The economy is going into a recession and my own view is that it will be deep and quite long-lasting. There doesn't seem to be anything on the horizon that is a bright spot."

In the wake of crumbling stock markets, mounting bad debt and rising unemployment, policymakers are scrambling to devise strategies to restore stability and lay the groundwork for new growth. "There's no country in the world that's doing well," Allen continues. "Everybody is doing badly, with large amounts of debt and heading toward deflation," plus "unemployment and a rush by companies to fire people."

The collapse in the United States is different than in other industrialized countries around the world because the problems began in the financial sector and spread out into the broader economy, says Wharton management professor Mauro Guillén. In the rest of the world, problems in the real economy -- created largely by trouble in the United States -- led to weakness in financial markets. "In the United States, the key in 2009 is, 'Can we clear up the mess in the financial sector?' Unfortunately, I'm not very optimistic," says Guillén.

Wharton finance professor Richard Marston says he is shocked by the impact of the crisis on U.S. financial firms and markets. "To see Wachovia, Wash Mutual, Citi all gravely wounded. It's extraordinary." Marston contends that while the banks have been shored up, they are unlikely to lend for a long time. On top of that, he adds, the inability to securitize will constrain credit more than if banks alone had cut back on lending. (Continued here)

January 7, 2009

After a year of financial shock and sharp economic loss, 2009 is likely to be extremely difficult for the global economy, with investors, business leaders and policymakers struggling to find signs of recovery, according to Wharton faculty and academic partners around the world.

"It's all pretty negative," says Wharton finance professor Franklin Allen. "The economy is going into a recession and my own view is that it will be deep and quite long-lasting. There doesn't seem to be anything on the horizon that is a bright spot."

In the wake of crumbling stock markets, mounting bad debt and rising unemployment, policymakers are scrambling to devise strategies to restore stability and lay the groundwork for new growth. "There's no country in the world that's doing well," Allen continues. "Everybody is doing badly, with large amounts of debt and heading toward deflation," plus "unemployment and a rush by companies to fire people."

The collapse in the United States is different than in other industrialized countries around the world because the problems began in the financial sector and spread out into the broader economy, says Wharton management professor Mauro Guillén. In the rest of the world, problems in the real economy -- created largely by trouble in the United States -- led to weakness in financial markets. "In the United States, the key in 2009 is, 'Can we clear up the mess in the financial sector?' Unfortunately, I'm not very optimistic," says Guillén.

Wharton finance professor Richard Marston says he is shocked by the impact of the crisis on U.S. financial firms and markets. "To see Wachovia, Wash Mutual, Citi all gravely wounded. It's extraordinary." Marston contends that while the banks have been shored up, they are unlikely to lend for a long time. On top of that, he adds, the inability to securitize will constrain credit more than if banks alone had cut back on lending. (Continued here)

Posted by

Clifford J. Wirth, Ph.D., Professor Emeritus, University of New Hampshire

at

Wednesday, January 21, 2009

0

comments

Labels:

depression,

economy,

peak oil,

recession

The World Bank: Global Economic Prospects 2009

Outlook Summary, December 9, 2008

The stresses in the financial markets of the United States that first emerged in the summer of 2007 transformed themselves into a full-blown global financial crisis in the fall of 2008: credit markets froze; stock markets crashed; and a sequence of insolvencies threatened the entire international financial system.

Massive liquidity injections by central banks and a variety of stopgap measures by governments proved inadequate to contain the crisis at first.

The initially hesitant policy response has become increasingly robust.

The United States government introduced a $700 billion rescue package and has taken equity positions in nine major banks and several large regional banks.

Various debt and deposit guarantees have also been introduced.

At the same time, European governments have announced plans for equity injections and purchases of bank assets worth some $460 billion, along with up to almost $2 trillion in guarantees of bank debt.

At the time of this writing, November 20, 2008, markets remain volatile despite the forcefulness of these measures and signs that credit conditions are improving somewhat in high-income countries.

Both private-sector and sovereign interest rate spreads for developing countries have spiked even higher, and a growing list of countries have been forced to seek assistance from the International Monetary Fund (IMF).

During the initial phases of this financial crisis in 2007, the effects of the financial turmoil on developing countries were relatively modest.

However, as the crisis intensified in 2008 and especially since mid-September, risk aversion (the absence of which had been the hallmark of the preceding boom) has increased, and capital flows to developing countries have seized up.

As a result, the currencies of a wide range of developing countries depreciated sharply, and developing-market equity prices have given up almost all of their gains since the beginning of 2008.

Initial public equity offerings have disappeared, and risk premiums have increased to more than 700 basis points on sovereign bonds and to more than 1,000 basis points on the debt of developing- country firms.

Very recent data on bank lending and foreign direct investment inflows are not available, but indications are that these inflows have also declined, but less dramatically.

Virtually no country, developing or high- income, has escaped the impact of the widening crisis, although those countries with stronger fundamentals going into the crisis have been less affected.

The deterioration in financing conditions has been most severe in countries with large current account deficits, and in those that showed signs of overheating and unsustainably rapid credit creation before the financial crisis intensified.

Of the 20 developing countries whose economies have reacted most sharply to the deterioration in conditions (as measured by exchange rate depreciation, increase in spreads, and equity market declines), 6 come from Europe and Central Asia, and 8 from Latin America and the Caribbean.

In this climate, growth prospects for both high-income and developing countries have deteriorated substantially, and the possibility of a serious global recession cannot be ruled out.

Even if the waves of panic that have inundated credit and equity markets across the world are soon brought under control, the crisis is likely to cause a sharp slowdown in activity stemming from the deleveraging in financial markets that has already occurred and that is expected to continue.

In the baseline forecast presented in this chapter, much tighter credit conditions, weaker capital inflows to middle-income countries, and a sharp reduction in global import demand are expected to be the main factors driving the slowdown in developing countries.

Import demand is projected to decline by 3.4 percent in high-income countries during 2009, while net private debt and equity flows to developing countries are projected to decline from $1 trillion in 2007 to about $530 billion in 2009, or from 7.7 to 3 percent of developing-country GDP.

As a result, investment growth in developing countries is projected to slow dramatically, rising only 3.5 percent in middle-income countries, compared with a 13.2 percent increase in 2007.

A pronounced recession is believed to have begun in mid-2008 in Europe, Japan, and most recently, the United States.

This recession is projected to extend into 2009, yielding a decline in high-income country GDP of 0.1 percent that year (see Forecast summary table).

In developing countries, growth is projected to slow to 4.5 percent in 2009, down from 7.9 and 6.3 percent in 2007 and 2008.

Overall, global GDP is projected to expand only 0.9 percent in 2009 (figure 1.1)— below the rate recorded in 2001 and 1991 and indeed, the weakest since records became available beginning in 1970.

Because low-income countries have less access to international capital markets, the slowdown will affect them mainly through indirect mechanisms, including reduced demand for their exports, lower commodity prices, and reduced remittance inflows.

International trade is projected to decelerate sharply, with global export volumes falling by 2.1 percent in 2009—the first time they have declined since 1982 and eclipsing the 1.9 percent falloff that occurred in 1975.

Export opportunities for developing countries will fade rapidly because of the recession in high-income countries and because export credits are drying up and export insurance has become more expensive.

Slower growth in high-income countries is estimated to have reduced remittance flows into developing countries from 2 to 1.8 percent of recipient country GDP between 2007 and 2008. At the country level, the extent of further slowdown will depend critically on exchange rate developments, with recent swings in bilateral exchange rates dwarfing the expected changes in remittances denominated in host-country currencies.

The global growth recession is projected to cause both commodity prices and inflation to ease further, with oil prices averaging about $75 a barrel (bbl) in 2009, and food and metal prices projected to decline by about 23 and 26 percent, respectively, compared with their average levels in 2008.

Nevertheless, commodity prices will remain well above the very low levels of the 1990s. Lower commodity prices should reduce the burden on some segments of the poor (notably urban dwellers), whose purchasing power has declined because of high food and fuel prices (see chapter 3 of Global Economic Prospects 2009).

Lower prices should also help dampen headline inflation.

Indeed, the rapid rise of food and energy prices over the course of 2007 and the first half of 2008, coupled with tight capacity in many countries (following years of very fast growth fueled by ample liquidity) caused headline and core inflation to pick up throughout the world.

Headline inflation increased by 5 percentage points or more in most developing countries, and more than half of developing countries had an inflation rate in excess of 10 percent by the middle of 2008.

This financial crisis and the expected abrupt slowing of global growth comes at a moment when developing countries considered as a whole are more vulnerable than they have been in the recent past.

Higher commodity prices have widened current account deficits of many oil-importing countries to worrisome levels (they exceed 10 percent of GDP in about one-third of developing countries), and after having increased substantially, the international reserves of oil-exporting developing countries are now declining as a share of their imports. Moreover, inflation is high, and fiscal positions have deteriorated both for cyclical reasons and because government spending has increased to alleviate some of the burden of higher commodity prices.

Although the global recession is likely to be protracted, some elements of an eventual recovery can already be discerned.

These include early movement toward stabilization in the housing sector in the United States; continued progress on debt workouts and a strengthening of balance sheets among both banks and households; a gradual easing of credit conditions as government rescue packages take hold and investors begin to return to heavily discounted equity markets; increases in real incomes (stemming from lower food and fuel prices) among individuals with relatively high marginal propensities to consume; and increased space for fiscal and monetary policies as inflationary pressures ease and government outlays on food and fuel subsidies decline in tandem.

Although this sober outlook represents a likely outcome, the situation remains unstable, and a wide range of outcomes are possible, including a scenario where the rebound of growth in 2010 is weaker, held back by continuing banking sector restructuring, and negative wealth effects resulting from lower housing and stock market prices.

An even sharper recession is also possible. If the freeze in credit markets does not thaw as anticipated in the baseline, the consequences for developing countries could be catastrophic.

Financing conditions would deteriorate rapidly, and apparently sound domestic financial sectors could find themselves unable to borrow or unwilling to lend—in both international and domestic markets.

Such a scenario would be characterized by a long and profound recession in high-income countries and substantial disruption and turmoil, including bank failures and currency crises, in a wide range of developing countries.

Sharply negative growth in a number of developing countries with all of the attendant repercussions, including increased poverty and unemployment, would be inevitable.

Although it is a receding concern, high inflation in developing countries remains a problem, especially if the impact from the current crisis on developing-country investment demand is less pronounced, and the stimulus provided by various rescue and fiscal packages in high- income and developing countries feeds a rapid expansion in demand.

Under such a scenario, global growth would still slow in 2009, which would tend to dampen inflationary pressures initially, but growth could be expected to snap back much more sharply in 2010.

Countries that now have large current account deficits and high inflation could suffer from a renewed overheating of their economies.

Policies would have to be very prudent in these circumstances, because the currencies of these countries are likely to remain sensitive to changing market perceptions and increased risk aversion.

The challenge for policy makers is not only to prevent an escalation of the crisis and to mitigate the downturn but also to ensure a good starting position once the rebound sets in.

For developing countries, this means responding rapidly and forcefully to signs of weakness in domestic banking sectors, including resorting to international assistance where necessary.

It also means pursuing a prudent countercyclical policy, relying on automatic stabilizers, social safety nets, and infrastructure investment that addresses bottlenecks that have become binding constraints on long-term sustainable growth in many countries.

In the current circumstances of heightened risk aversion and investor skittishness, policy makers need to be especially wary of taking on excessive levels of debt or creating the conditions for an inflationary bubble by reacting too aggressively to the global slowdown.

Although it is important for policy makers to react quickly to emerging problems, it is also essential that steps and conditions attached to assistance be well focused on overcoming some of the fundamental sources of weakness.

Otherwise there is a risk that governments lose the support of markets and taxpayers in their efforts to limit the extent of near-term disruptions.

The stresses in the financial markets of the United States that first emerged in the summer of 2007 transformed themselves into a full-blown global financial crisis in the fall of 2008: credit markets froze; stock markets crashed; and a sequence of insolvencies threatened the entire international financial system.

Massive liquidity injections by central banks and a variety of stopgap measures by governments proved inadequate to contain the crisis at first.

The initially hesitant policy response has become increasingly robust.

The United States government introduced a $700 billion rescue package and has taken equity positions in nine major banks and several large regional banks.

Various debt and deposit guarantees have also been introduced.

At the same time, European governments have announced plans for equity injections and purchases of bank assets worth some $460 billion, along with up to almost $2 trillion in guarantees of bank debt.

At the time of this writing, November 20, 2008, markets remain volatile despite the forcefulness of these measures and signs that credit conditions are improving somewhat in high-income countries.

Both private-sector and sovereign interest rate spreads for developing countries have spiked even higher, and a growing list of countries have been forced to seek assistance from the International Monetary Fund (IMF).

During the initial phases of this financial crisis in 2007, the effects of the financial turmoil on developing countries were relatively modest.

However, as the crisis intensified in 2008 and especially since mid-September, risk aversion (the absence of which had been the hallmark of the preceding boom) has increased, and capital flows to developing countries have seized up.

As a result, the currencies of a wide range of developing countries depreciated sharply, and developing-market equity prices have given up almost all of their gains since the beginning of 2008.

Initial public equity offerings have disappeared, and risk premiums have increased to more than 700 basis points on sovereign bonds and to more than 1,000 basis points on the debt of developing- country firms.

Very recent data on bank lending and foreign direct investment inflows are not available, but indications are that these inflows have also declined, but less dramatically.

Virtually no country, developing or high- income, has escaped the impact of the widening crisis, although those countries with stronger fundamentals going into the crisis have been less affected.

The deterioration in financing conditions has been most severe in countries with large current account deficits, and in those that showed signs of overheating and unsustainably rapid credit creation before the financial crisis intensified.

Of the 20 developing countries whose economies have reacted most sharply to the deterioration in conditions (as measured by exchange rate depreciation, increase in spreads, and equity market declines), 6 come from Europe and Central Asia, and 8 from Latin America and the Caribbean.

In this climate, growth prospects for both high-income and developing countries have deteriorated substantially, and the possibility of a serious global recession cannot be ruled out.

Even if the waves of panic that have inundated credit and equity markets across the world are soon brought under control, the crisis is likely to cause a sharp slowdown in activity stemming from the deleveraging in financial markets that has already occurred and that is expected to continue.

In the baseline forecast presented in this chapter, much tighter credit conditions, weaker capital inflows to middle-income countries, and a sharp reduction in global import demand are expected to be the main factors driving the slowdown in developing countries.

Import demand is projected to decline by 3.4 percent in high-income countries during 2009, while net private debt and equity flows to developing countries are projected to decline from $1 trillion in 2007 to about $530 billion in 2009, or from 7.7 to 3 percent of developing-country GDP.

As a result, investment growth in developing countries is projected to slow dramatically, rising only 3.5 percent in middle-income countries, compared with a 13.2 percent increase in 2007.

A pronounced recession is believed to have begun in mid-2008 in Europe, Japan, and most recently, the United States.

This recession is projected to extend into 2009, yielding a decline in high-income country GDP of 0.1 percent that year (see Forecast summary table).

In developing countries, growth is projected to slow to 4.5 percent in 2009, down from 7.9 and 6.3 percent in 2007 and 2008.

Overall, global GDP is projected to expand only 0.9 percent in 2009 (figure 1.1)— below the rate recorded in 2001 and 1991 and indeed, the weakest since records became available beginning in 1970.

Because low-income countries have less access to international capital markets, the slowdown will affect them mainly through indirect mechanisms, including reduced demand for their exports, lower commodity prices, and reduced remittance inflows.

International trade is projected to decelerate sharply, with global export volumes falling by 2.1 percent in 2009—the first time they have declined since 1982 and eclipsing the 1.9 percent falloff that occurred in 1975.

Export opportunities for developing countries will fade rapidly because of the recession in high-income countries and because export credits are drying up and export insurance has become more expensive.

Slower growth in high-income countries is estimated to have reduced remittance flows into developing countries from 2 to 1.8 percent of recipient country GDP between 2007 and 2008. At the country level, the extent of further slowdown will depend critically on exchange rate developments, with recent swings in bilateral exchange rates dwarfing the expected changes in remittances denominated in host-country currencies.

The global growth recession is projected to cause both commodity prices and inflation to ease further, with oil prices averaging about $75 a barrel (bbl) in 2009, and food and metal prices projected to decline by about 23 and 26 percent, respectively, compared with their average levels in 2008.

Nevertheless, commodity prices will remain well above the very low levels of the 1990s. Lower commodity prices should reduce the burden on some segments of the poor (notably urban dwellers), whose purchasing power has declined because of high food and fuel prices (see chapter 3 of Global Economic Prospects 2009).

Lower prices should also help dampen headline inflation.

Indeed, the rapid rise of food and energy prices over the course of 2007 and the first half of 2008, coupled with tight capacity in many countries (following years of very fast growth fueled by ample liquidity) caused headline and core inflation to pick up throughout the world.

Headline inflation increased by 5 percentage points or more in most developing countries, and more than half of developing countries had an inflation rate in excess of 10 percent by the middle of 2008.

This financial crisis and the expected abrupt slowing of global growth comes at a moment when developing countries considered as a whole are more vulnerable than they have been in the recent past.

Higher commodity prices have widened current account deficits of many oil-importing countries to worrisome levels (they exceed 10 percent of GDP in about one-third of developing countries), and after having increased substantially, the international reserves of oil-exporting developing countries are now declining as a share of their imports. Moreover, inflation is high, and fiscal positions have deteriorated both for cyclical reasons and because government spending has increased to alleviate some of the burden of higher commodity prices.

Although the global recession is likely to be protracted, some elements of an eventual recovery can already be discerned.

These include early movement toward stabilization in the housing sector in the United States; continued progress on debt workouts and a strengthening of balance sheets among both banks and households; a gradual easing of credit conditions as government rescue packages take hold and investors begin to return to heavily discounted equity markets; increases in real incomes (stemming from lower food and fuel prices) among individuals with relatively high marginal propensities to consume; and increased space for fiscal and monetary policies as inflationary pressures ease and government outlays on food and fuel subsidies decline in tandem.

Although this sober outlook represents a likely outcome, the situation remains unstable, and a wide range of outcomes are possible, including a scenario where the rebound of growth in 2010 is weaker, held back by continuing banking sector restructuring, and negative wealth effects resulting from lower housing and stock market prices.

An even sharper recession is also possible. If the freeze in credit markets does not thaw as anticipated in the baseline, the consequences for developing countries could be catastrophic.

Financing conditions would deteriorate rapidly, and apparently sound domestic financial sectors could find themselves unable to borrow or unwilling to lend—in both international and domestic markets.

Such a scenario would be characterized by a long and profound recession in high-income countries and substantial disruption and turmoil, including bank failures and currency crises, in a wide range of developing countries.

Sharply negative growth in a number of developing countries with all of the attendant repercussions, including increased poverty and unemployment, would be inevitable.

Although it is a receding concern, high inflation in developing countries remains a problem, especially if the impact from the current crisis on developing-country investment demand is less pronounced, and the stimulus provided by various rescue and fiscal packages in high- income and developing countries feeds a rapid expansion in demand.

Under such a scenario, global growth would still slow in 2009, which would tend to dampen inflationary pressures initially, but growth could be expected to snap back much more sharply in 2010.

Countries that now have large current account deficits and high inflation could suffer from a renewed overheating of their economies.

Policies would have to be very prudent in these circumstances, because the currencies of these countries are likely to remain sensitive to changing market perceptions and increased risk aversion.

The challenge for policy makers is not only to prevent an escalation of the crisis and to mitigate the downturn but also to ensure a good starting position once the rebound sets in.

For developing countries, this means responding rapidly and forcefully to signs of weakness in domestic banking sectors, including resorting to international assistance where necessary.

It also means pursuing a prudent countercyclical policy, relying on automatic stabilizers, social safety nets, and infrastructure investment that addresses bottlenecks that have become binding constraints on long-term sustainable growth in many countries.

In the current circumstances of heightened risk aversion and investor skittishness, policy makers need to be especially wary of taking on excessive levels of debt or creating the conditions for an inflationary bubble by reacting too aggressively to the global slowdown.

Although it is important for policy makers to react quickly to emerging problems, it is also essential that steps and conditions attached to assistance be well focused on overcoming some of the fundamental sources of weakness.

Otherwise there is a risk that governments lose the support of markets and taxpayers in their efforts to limit the extent of near-term disruptions.

Posted by

Clifford J. Wirth, Ph.D., Professor Emeritus, University of New Hampshire

at

Wednesday, January 21, 2009

0

comments

TCH on the Economy (TCH is an economist with a Wharton School MBA)

THC Email to Clifford Wirth, January 1, 2009

One way or another we are all in a fine mess. The world economy is close to cratering and the US is headed for a period of hyper-inflation and stagflation while government issued debt crowds out the private sector from the credit markets.

Oil is the other shoe in the mess. The current credit crunch has lowered demand and oil prices. Can oil companies explore and produce remaining expensive oil with prices below $50 per barrel?

One way or another we are all in a fine mess. The world economy is close to cratering and the US is headed for a period of hyper-inflation and stagflation while government issued debt crowds out the private sector from the credit markets.

Oil is the other shoe in the mess. The current credit crunch has lowered demand and oil prices. Can oil companies explore and produce remaining expensive oil with prices below $50 per barrel?

Posted by

Clifford J. Wirth, Ph.D., Professor Emeritus, University of New Hampshire

at

Wednesday, January 21, 2009

0

comments

Labels:

credit markets,

economy,

oil prices

Tuesday, January 20, 2009

Financial Forecast for 2009, by Gail Tverberg

Excerpts from Theoildrum.com, January 6, 2009 (the full article includes much data and is followed by a discussion).

We are due for a debt unwind, and with it a rapid decline in the US standard of living. Exactly what form it will take, and what the timing will be (for example, sudden one month from now or sudden three years from now, or gradual over a longer period), isn't certain. I would expect that many (or most) other economies in the world will be dragged along in this debt unwind and will experience a decline in their standards of living.

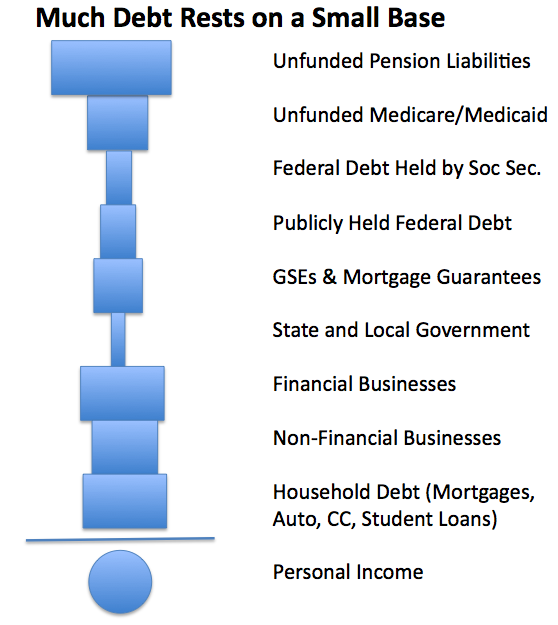

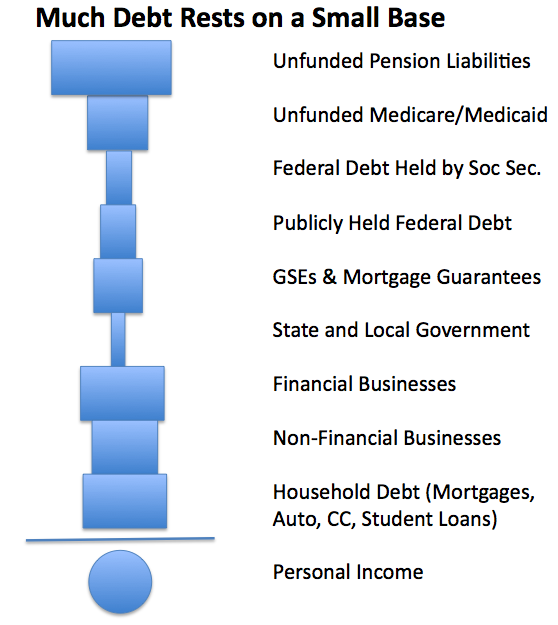

Many asset classes are correlated in time of stress, the tower of debt (Figure 1) has many feedback loops, and tends to magnify the economy's reaction to events, both favorable and unfavorable.

(FIGURE 1) (click on figure to read)

When consumer debt is rising it tends to make the economy look very, very good. When there are layoffs, the interrelationships tend to magnify the impact, making the economic impact much worse. One wonders whether there are tipping points, beyond which it is not really possible for the system to recover--particularly now that the US seems to be at the point of "peak energy" (Section 3), energy is required for growth (Section 3), and growth is required to allow debt to continue (Section 2).

The tower of debt is in some ways deceptive. It can make the economy look mostly OK to the casual observer, until all too quickly, things start to fall apart.

So far, the "fixes" that the US government has been attempting seem mostly counterproductive. Putting government guarantees behind more and more debt (thus stacking Figure 1 higher and higher, with a new TARP layer) just increases the likelihood that the US government will be drawn into the downward spiral. The financial services layer will be less and less needed in years ahead, as our need for debt-based products declines. Bailing it out does not help get additional income to ordinary workers (although it may temporarily protect them from losing their bank account balances).

All aspects of finances will be affected by the unwind of debt. A huge amount of debt will be defaulted on (or will be forgiven, so that an actual default does not need to occur). Regardless of whether the non-payment occurs because of default or forgiveness, the effect on financial institutions will be the same. Financial institutions such as banks, insurance companies, pension funds, and many hedge funds will find themselves in poor financial condition, because they were depending on the proceeds of this debt repayment to fund what they have promised--bank account balances; insurance policies; pension payments; or hedge fund returns. Institutions guaranteeing debt, such as monoline bond insurers will be particularly hard hit. The FDIC will likely be called on to rescue many failed banks, and will need to find funds from some source (printed money?) to do this.

As the year goes on, I expect each evaluation of where we are to be worse. Banks will report operating losses each quarter. Fannie and Freddie will need more funds than originally thought. TARP will need more funds than original planned. More and more businesses will enter bankruptcy, and more and more governments (states, cities, counties, and countries around the world) will find themselves unable to meet their obligations. There are a huge number of inter-relationships, and the bankruptcies and losses in one area will tend to cause more bankruptcies and losses in other areas, and act to destabilize the debt tower.

Debt of all forms will be very difficult to obtain, except through government sources. The interest rate the US government is currently paying is very low, mainly because of a "flight to quality". If the US government keeps issuing more and more debt, it seems likely that at some point this will change, because buyers will figure out that even if the US is the best of a bad lot, its risk of failure is significantly greater than 0%.

I do not expect a steep rise in the price of oil and natural gas in the next year, because the decline in demand is likely to outpace the decline in production in the short-term. If we look back at Figure 2, I expect that funds available to ordinary citizens will continue to decline in 2009, even considering any stimulus plan. This will happen because employee compensation will decline due to layoffs. Household debt outstanding will also decline (rather than just stay flat, as it has in the past year), because of the poor financial condition of lending institutions, and because with the poor economy, the risk of borrower default will be quite high, discouraging lending. A $300 billion stimulus program will be tiny in comparison to the boost the economy got in the past from increasing debt and greater refinancing (up to $2 trillion per year), as the prices of homes increased. With lower incomes, lower (actually net negative) cash flow from borrowing, and only a modest boost from a stimulus program, citizens will have less and less to spend on goods and services.

There is a distinct possibility that this could all end very badly. One possibility is that there will be more and more defaults, and the US government will not be able to prop up all of the institutions and will eventually default on its debt. While this seems to be the direction things are headed at the current time, the much more usual outcome is hyperinflation, caused by printing more and more money, wiping out the value of people's savings and pensions. Situations such as these are often accompanied by a new government (including a new constitution), and may even include different country boundaries (for example, Soviet Union after its fall).

Many people have started making preparation for the time when food needs to be produced locally and electricity is often not available. I would not discourage such preparations. While we do not know that the economy will collapse completely, I think such preparations are prudent, in the face of rising risk. Preparation for a major change takes many years, so starting earlier rather than later makes sense. Also, with the tower of debt (Figure 1) and the many feedback loops, the downward spiral can happen more quickly than our prior experience suggests is possible.

In conclusion, 2009 looks like a very challenging year for the new administration and for the world as a whole.

We are due for a debt unwind, and with it a rapid decline in the US standard of living. Exactly what form it will take, and what the timing will be (for example, sudden one month from now or sudden three years from now, or gradual over a longer period), isn't certain. I would expect that many (or most) other economies in the world will be dragged along in this debt unwind and will experience a decline in their standards of living.

Many asset classes are correlated in time of stress, the tower of debt (Figure 1) has many feedback loops, and tends to magnify the economy's reaction to events, both favorable and unfavorable.

(FIGURE 1) (click on figure to read)

When consumer debt is rising it tends to make the economy look very, very good. When there are layoffs, the interrelationships tend to magnify the impact, making the economic impact much worse. One wonders whether there are tipping points, beyond which it is not really possible for the system to recover--particularly now that the US seems to be at the point of "peak energy" (Section 3), energy is required for growth (Section 3), and growth is required to allow debt to continue (Section 2).

The tower of debt is in some ways deceptive. It can make the economy look mostly OK to the casual observer, until all too quickly, things start to fall apart.

So far, the "fixes" that the US government has been attempting seem mostly counterproductive. Putting government guarantees behind more and more debt (thus stacking Figure 1 higher and higher, with a new TARP layer) just increases the likelihood that the US government will be drawn into the downward spiral. The financial services layer will be less and less needed in years ahead, as our need for debt-based products declines. Bailing it out does not help get additional income to ordinary workers (although it may temporarily protect them from losing their bank account balances).

All aspects of finances will be affected by the unwind of debt. A huge amount of debt will be defaulted on (or will be forgiven, so that an actual default does not need to occur). Regardless of whether the non-payment occurs because of default or forgiveness, the effect on financial institutions will be the same. Financial institutions such as banks, insurance companies, pension funds, and many hedge funds will find themselves in poor financial condition, because they were depending on the proceeds of this debt repayment to fund what they have promised--bank account balances; insurance policies; pension payments; or hedge fund returns. Institutions guaranteeing debt, such as monoline bond insurers will be particularly hard hit. The FDIC will likely be called on to rescue many failed banks, and will need to find funds from some source (printed money?) to do this.

As the year goes on, I expect each evaluation of where we are to be worse. Banks will report operating losses each quarter. Fannie and Freddie will need more funds than originally thought. TARP will need more funds than original planned. More and more businesses will enter bankruptcy, and more and more governments (states, cities, counties, and countries around the world) will find themselves unable to meet their obligations. There are a huge number of inter-relationships, and the bankruptcies and losses in one area will tend to cause more bankruptcies and losses in other areas, and act to destabilize the debt tower.

Debt of all forms will be very difficult to obtain, except through government sources. The interest rate the US government is currently paying is very low, mainly because of a "flight to quality". If the US government keeps issuing more and more debt, it seems likely that at some point this will change, because buyers will figure out that even if the US is the best of a bad lot, its risk of failure is significantly greater than 0%.

I do not expect a steep rise in the price of oil and natural gas in the next year, because the decline in demand is likely to outpace the decline in production in the short-term. If we look back at Figure 2, I expect that funds available to ordinary citizens will continue to decline in 2009, even considering any stimulus plan. This will happen because employee compensation will decline due to layoffs. Household debt outstanding will also decline (rather than just stay flat, as it has in the past year), because of the poor financial condition of lending institutions, and because with the poor economy, the risk of borrower default will be quite high, discouraging lending. A $300 billion stimulus program will be tiny in comparison to the boost the economy got in the past from increasing debt and greater refinancing (up to $2 trillion per year), as the prices of homes increased. With lower incomes, lower (actually net negative) cash flow from borrowing, and only a modest boost from a stimulus program, citizens will have less and less to spend on goods and services.

There is a distinct possibility that this could all end very badly. One possibility is that there will be more and more defaults, and the US government will not be able to prop up all of the institutions and will eventually default on its debt. While this seems to be the direction things are headed at the current time, the much more usual outcome is hyperinflation, caused by printing more and more money, wiping out the value of people's savings and pensions. Situations such as these are often accompanied by a new government (including a new constitution), and may even include different country boundaries (for example, Soviet Union after its fall).

Many people have started making preparation for the time when food needs to be produced locally and electricity is often not available. I would not discourage such preparations. While we do not know that the economy will collapse completely, I think such preparations are prudent, in the face of rising risk. Preparation for a major change takes many years, so starting earlier rather than later makes sense. Also, with the tower of debt (Figure 1) and the many feedback loops, the downward spiral can happen more quickly than our prior experience suggests is possible.

In conclusion, 2009 looks like a very challenging year for the new administration and for the world as a whole.

Posted by

Clifford J. Wirth, Ph.D., Professor Emeritus, University of New Hampshire

at

Tuesday, January 20, 2009

0

comments

Labels:

depression,

economy,

peak oil,

recession

Series of Posts on the Economy: Peak Oil Planning for 2009

To better plan for Peak Oil impacts, we must understand the how we arrived at the current economic downturn and then forecast what lies ahead for 2009 and the future.

Over the next two days, I will post several articles and comments which explain the current economy and make forecasts for 2009 and the years ahead. To move toward an objective analysis, I will provide a variety of views on the economy.

Readers are welcome to make comments or email me their own assessment which I will post.

Subsequently, I will add a post that relates the economic assessments to oil production forecasts. This analysis will provide a base for making recommendations about planning for Peak Oil impacts.

Over the next two days, I will post several articles and comments which explain the current economy and make forecasts for 2009 and the years ahead. To move toward an objective analysis, I will provide a variety of views on the economy.

Readers are welcome to make comments or email me their own assessment which I will post.

Subsequently, I will add a post that relates the economic assessments to oil production forecasts. This analysis will provide a base for making recommendations about planning for Peak Oil impacts.

Posted by

Clifford J. Wirth, Ph.D., Professor Emeritus, University of New Hampshire

at

Tuesday, January 20, 2009

1 comments

Labels:

econmic forecasting,

economy,

peak oil,

planning

Monday, January 19, 2009

Peak Oil and the Century of Famine, by Peter Goodchild

From Countercurrents.org, January 5, 2009

Around the beginning of the twenty-first century, there began a clash of two gigantic forces: overpopulation and oil depletion. The event went unnoticed by all but a few people, but it was quite real. As a result of that clash, the number of human beings on Earth must one day decline in order to match the decline in oil production.

Unfortunately, there seems to be no way to get those two giant forces into equilibrium in any gentle fashion, because in every year that has gone by for the last few thousand years — and every year that will arrive — the human population of Earth is automatically adjusted so that it is roughly equal to the planet’s carrying capacity. Like so many other animals, human beings always push themselves to the limits of that carrying capacity. The Age of Petroleum made us no wiser in that respect, and in fact dependence on fossil fuels has led us to a crisis far greater than any in the past.

(Continued here)

Around the beginning of the twenty-first century, there began a clash of two gigantic forces: overpopulation and oil depletion. The event went unnoticed by all but a few people, but it was quite real. As a result of that clash, the number of human beings on Earth must one day decline in order to match the decline in oil production.

Unfortunately, there seems to be no way to get those two giant forces into equilibrium in any gentle fashion, because in every year that has gone by for the last few thousand years — and every year that will arrive — the human population of Earth is automatically adjusted so that it is roughly equal to the planet’s carrying capacity. Like so many other animals, human beings always push themselves to the limits of that carrying capacity. The Age of Petroleum made us no wiser in that respect, and in fact dependence on fossil fuels has led us to a crisis far greater than any in the past.

(Continued here)

Posted by

Clifford J. Wirth, Ph.D., Professor Emeritus, University of New Hampshire

at

Monday, January 19, 2009

0

comments

Labels:

famine,

peak oil,

population

Subscribe to:

Comments (Atom)